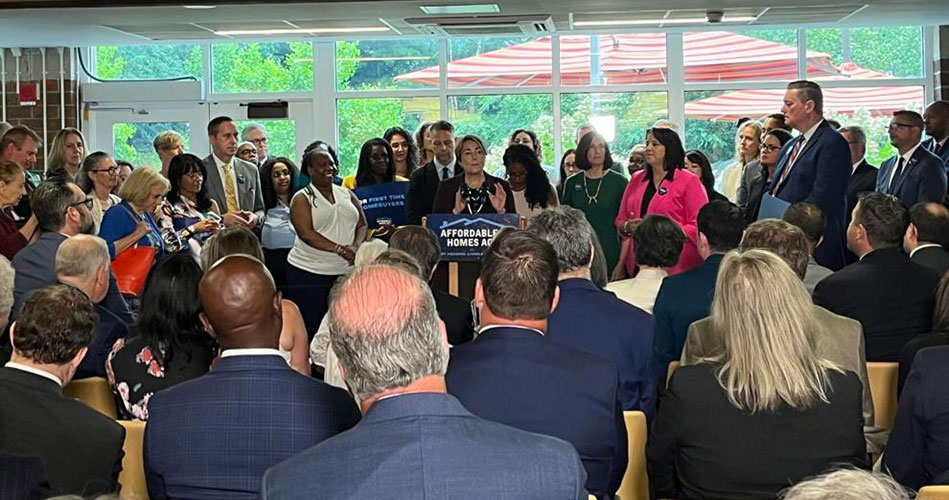

GOV. MAURA HEALEY speaks to a crowd of over one hundred at a bill signing event in Newton on Tuesday, Aug. 6, 2024, before signing a $5.2 billion housing bond bill.

By SAM DRYSDALE

State House News Service

BOSTON — As Gov. Maura Healey and lawmakers celebrated what they called “historic” housing legislation getting signed into law Tuesday, some of the advocates credited with influencing the bill say it is “underwhelming” and watered down, with a number of policies targeted at helping the state’s poorest residents left on the cutting room floor.

“Even though there’s some significant investments in the bond bill, particularly for affordable housing and public housing, it doesn’t meet the urgency of the moment. We were disappointed that policies to actually protect working class people in our state were not included in the bond bill,” Carolyn Chou of Homes for All Massachusetts said.

The bill authorizes $5.16 billion in bonding — though not all of that borrowing capacity will actually get used — and implements 49 new housing policies. Lawmakers left five policy proposals from Healey out of their compromise bill, and a number of House and Senate priorities were cut from the final law.

“Lots of minor stuff is not in there,” Sen. William Brownsberger, one of the lead negotiators, told reporters last Thursday morning when he filed the House-Senate compromise language.

Housing Secretary Ed Augustus told reporters Tuesday that, with the additions lawmakers made to the bill, his office estimates the legislation will lead to the creation of over 45,000 new units and the preservation of 27,000 — more than originally estimated from Healey’s proposal. Massachusetts is expected to have a 220,000-plus housing unit shortage by 2030.

He credited that increase to policies such as new tax credits for companies that convert unused commercial buildings to residential units, and doubling the tax credit to rehabilitate historic buildings.

Other policies that made it into the final bill include allowing accessory dwelling units by-right, eviction sealing, expanding a seasonal communities designation, and $2 billion of bond authorizations steered towards upgrading the state’s public housing stock. But advocates said they’re not sure the legislation will make enough of a dent in the state’s housing crisis with so much left on the table.

Between the original bill the governor filed in October and the final bill she signed Tuesday, all of the capital authorizations are funded at the same level or greater, and 23 of the 28 policies Healey proposed were included, according to a spokesperson for the Executive Office of Housing and Livable Communities.

The Healey-backed policies that didn’t make the cut were local option transfer taxes to pay for affordable housing, inclusionary zoning by simple majority, streamlining procurement requirements for the development of MassDOT- or MBTA-controlled facilities to sell or lease the property; exempting public housing redevelopment projects from certain labor requirements; and removing a requirement for local housing authorities to file a home rule petition in order to regionalize.

The Senate went along with Healey’s proposal to allow a simple majority voting threshold for inclusionary zoning ordinances and bylaws at the local level, with some restrictions. Inclusionary zoning refers to local policy that requires or provides incentives to developers to set aside a fraction of newly constructed housing units to be affordable.

The House left it out, and it didn’t make it into the final compromise bill.

“Inclusionary zoning is something that could have helped lower-income and working class communities,” Progressive Mass Director Jonathan Cohn said. “Legislators love the Housing Development Incentive Program, which is basically how do we build more high-end housing to gentrify Gateway Cities. They seemed to leave ideas that could have helped working or middle class people living in expensive cities.”

Of the governor’s proposals, the transfer fee, especially, was touted by housing advocates as an important piece of addressing the housing crisis and giving municipalities more tools.

“We think that this was an easy way to expand funding for affordable housing in the communities where affordable housing is most needed, where housing prices have gone through the roof, whether it’s Boston, Cambridge, Somerville or the Cape and islands. So that was a profound disappointment, and one where we think the real estate lobby exerted their influence,” Charlie Homer of advocacy group Greater Boston Interfaith Organization said.

Neither chamber included the transfer fee in its housing bill. Asked by reporters Tuesday if she would go to bat for the policy again, Healey would not commit to making another push for it.

“I’m going to evaluate,” she responded, after the bill signing. “I’m committed right now to making sure that we implement the nearly 49, 50 policy measures that are in this bill, along with making sure we get money out the door.”

Senate-backed initiatives absent from the final law include a policy requiring broker’s fees to be paid by landlords rather than tenants, and grants for rural and mid-sized suburban town housing.

Sen. Lydia Edwards, Senate chair of the Housing Committee, said in June that the broker’s fee restructuring would have helped eliminate a barrier to housing for tenants.

Tenants are often required, when they first move into a new unit, to pay first month’s rent, last month’s rent, a security deposit and a fee for the real estate broker who showed them the apartment. Edwards said these costs can be between $12,000 and $15,000 on average.

“This would be incredibly impactful,” she said.

Cohn said he would have liked to see more robust tenant protections in the bill.

“The Senate’s language on broker’s fees — it was never that clear how much they were willing to fight for it. It didn’t seem to be something the governor cared about, the Senate had other priorities; it ended up on the chopping block as well,” he said.

Senate negotiators did secure an eviction sealing initiative in the bill, something that Edwards has made a priority since her time on the Boston City Council.

When Edwards testified on a housing bill in 2021, she called it the “scarlet letter E.”

“The fact is, if you file a case, the moment you create an eviction record that is permanent for life,” Edwards said at the time, adding that people of color, particularly Black women, are more than twice as likely to be evicted and “not given a softer landing” in the courts.

Andrea Park of the Massachusetts Law Reform Institute identified this policy as one of those in the final bill that will help with short-term housing solutions.

With the bill focused mainly on the production of new units, she said, there aren’t many solutions to help people stay in their home and in Massachusetts right now. The housing bond bill created an Office of Fair Housing, which Park also pointed to as a step in the right direction to prevent displacement.

“There are a number of eviction protections we pushed this session, and more that we think could be done,” she said. “Not defaulting people at their first court event, doing more to move rental assistance like RAFT further upstream, enabling rent stabilization — these are things we believe would have been able to stabilize housing prices in the short term, while we wait for new units to be built.”

Another policy that advocates were disappointed didn’t make it into the final bill, and has the same objective of meeting this short-term housing gap, is the so-called Tenant Opportunity to Purchase Act (TOPA).

The House included local option TOPA, also known as tenant right of first refusal, in its version of the bill. This policy would require multi-family property owners to notify their tenants and municipality when they decide to sell their property. Tenants would then have the right to make a first offer to purchase the housing after being notified of the sale.

Boston-based housing organization City Life/Vida Urbana has said the policy is a “key ingredient in preventing evictions and stabilizing housing for renters.”

Though the House was alone in supporting TOPA this session — and it didn’t make it’s way into the law Healey signed Tuesday — Democrats have supported the idea in the past.

Local option tenant right-to-purchase bylaws were in an economic development bill that Democrats passed in 2021, but the language was vetoed by former Gov. Charlie Baker. Because lawmakers waited until the final days of the two-year session to send the bill to his desk, Democrats left themselves without an opportunity to override the governor’s veto.

“I don’t know why it didn’t make it, but there’s work left to be done,” Chou said. “We certainly hope leadership doesn’t declare ‘mission accomplished’ on issues of housing and affordability, because they left so much on the table, and so much to keep everyday people in our state.”

Healey, Lt. Gov. Kim Driscoll, Edwards and House Housing Committee co-chair Rep. Jim Arciero all said during Tuesday’s bill signing event that the new law is meant to signify a first step in addressing the state’s housing crisis.

“We’re not saying mission accomplished,” Edwards said. “We’re saying ‘Mission is clear. Resources getting ready. Team is assembling.’ Because at the end of the day, we don’t forget people sleeping outside. We don’t forget about the people at Mass and Cass. We don’t forget about the people who are at the airport. We don’t forget about people working two or three jobs and watching their rent go up. We have not forgotten you. And I don’t want anyone to see this crowd celebrating and thinking ‘mission is accomplished.'”

On the same day lawmakers sent the major housing bill to Healey’s desk last week, restrictive family shelter regulations went into effect via guidance from the governor, which advocates say will lead to more families and young children sleeping in cars, hospital emergency rooms and on the streets.

Though the new law authorizes almost $5.2 billion of bonding for housing initiatives, not all of that is likely to be spent.

The state’s plan for actual capital spending released last month dedicates $2 billion for housing over the next five years, and the state is currently limited to about $400 million a year in capital spending on housing under its latest five-year capital budget. Bond authorization laws only add to the menu of spending options for executive branch officials to choose from, while operating within the constraints of an annual state bond cap.

The $400 million bonding in fiscal 2025 represents a 30 percent increase over fiscal 2024, but still limits Healey’s options.

“Having it be a $5.2 billion authorization means more money will be spent, and it’s an increase from what Baker did, but with all bonding, there’s so much that needs to happen for it to yield results. And unlike Baker, I think Healey wants to actually spend that money. But now all these priorities that actually made it into the bill will be competing with each other for actual spending,” Cohn said.

Most of the bond authorizations that had the backing of only one chamber died in the final compromise.

“The bill, ultimately from a financial standpoint, is a skinny bill, in the sense that it only includes the financial items that both branches agreed to; it’s what you call a low-low negotiation,” Brownsberger said during Thursday’s Senate session. “So it doesn’t include some of the more ambitious financial policy initiatives for either the House or the Senate.”

The “skinny bill” left out one of the highest-dollar bond authorizations proposed by either chamber: a $1 billion authorization to expand the Massachusetts Water Resource Authority’s service area to the Ipswich River basin and South Shore. House Speaker Ron Mariano made this a priority for his chamber, though it largely wasn’t part of the public conversation around the bonding bill until this spring when House Ways and Means revealed its version of the bill.

Mariano said expanding MWRA service to Weymouth could have created at least 6,000 homes, where a former U.S. Navy airfield has drawn the interest of developers but lacks the water and sewer infrastructure for significant new housing.

The largest bond authorizations are for the state’s public housing stock, which is in a state of disrepair. This includes $2 billion for repair and modernization of 43,000 units, $150 million to decarbonize public housing stock, $15 million for accessibility upgrades, and $200 million to support local housing authorities that partner with developers to add mixed-income developments on housing authority land.

The HousingWorks program was authorized for $425 million to support the preservation and new construction of projects, and up to $275 million could go to consolidating the existing Transit Oriented Housing Program and the Climate Resilient Housing Program to accelerate new production, where 25 percent of the funds must go towards projects that preserve housing for those with incomes below 60 percent of area median income.

The Affordable Housing Trust Fund was authorized for $800 million to create or preserve affordable housing for families earning less than 100 percent of area median income, up to $200 million will go to development of mixed-income multifamily housing, and $100 million is for middle-income affordable homes.

Another House-backed initiative that didn’t make the final cut was a requirement supported by the state’s construction unions that contractors repairing public hosing units offer apprenticeship programs to train the next generation of construction workers. The unions said the apprenticeship programs will help keep the vital industry alive as fewer young people are choosing careers in construction.

Though Healey and the Senate didn’t get behind the initiative, the governor announced Tuesday that Augustus had been working all weekend on “guidance that will ensure that affordable housing developments funded by many of the capital authorizations in this bill will be built by responsible contractors who treat their workers right.”

Tax credits in the new law include a new credit to incentivize production of homeownership units targeting households with incomes of up to 120 percent AMI, making project sponsors of commercial conversions eligible for a tax credit for up to 10 percent of the development costs, extending the Historic Rehabilitation Tax Credit through 2030 and doubling the total amount available from $55 million to $110 million, and making permanent the Community Investment Tax Credit.

“It’s a really big deal. It’s a really great day. It’s just a start. There’s more to do, but we are all intent and focused on getting after it in this next stage,” Healey said during the signing Tuesday.

Cohn, Park, Chou and other advocates said they hope lawmakers and Healey don’t put housing legislation on the backburner after the signing of Tuesday’s housing bond legislation.

“If you build a nice affordable development in 10 years that’s great, but by then Massachusetts’s low-income residents will be living in Rhode Island,” Cohn said.