The following is an open letter to the residents of North Reading from Town Administrator Michael P. Gilleberto

For the past year, the town’s Financial Planning Team (which consists of representatives of the Select Board, Finance Committee, and School Committee, as well as the Town Administrator, Finance Director, Superintendent of Schools, and Assistant Superintendent of Schools for Finance and Operations) has been working to prepare a budget for the fiscal year beginning this July 1st while also planning for future fiscal years.

Due to slowing new construction, the property tax revenue stream that has been a stabilizing force in our budgets – going back to the development of subdivisions with larger homes on larger house lots in the 1990’s, the construction of Edgewood Apartments at the former JT Berry property on Lowell Road in the 2000’s, and now the construction of Martin’s Landing condominiums at the JT Berry property from the 2010’s to 2020’s – is projected to decrease in upcoming years.

Additionally, conservative budgeting has allowed the town to generate Free Cash (funding left over from one year’s budget) to fund certain costs in the next year’s budget. Our ability to rely on this practice is coming to an end as we are forced to decrease the amount of money in department budgets and increase projections of other revenue streams. This combination of slowing new construction and tighter budgeting strategies will result in reduced money for services in upcoming fiscal years, and is further complicated by inflation.

The Financial Planning Team, with the support of the Select Board, Finance Committee, and School Committee, has presented the town a Fiscal Year 2025 Budget to be considered at the June 10 Town Meeting and a Proposition 2 ½ Override Election on June 18. A portion of the budget is within the limitations of Proposition 2 ½ but would require reductions in school and municipal department budgets, and a portion of the budget is contingent on a Proposition 2 ½ Override Election on June 18 and would maintain existing service levels.

A breakdown of the budget is as follows (more detail can be found on pages 19-35 of the Spring Annual Town Meeting Warrant mailed to each residential property last week, and available at www.northreadingma.gov):

- $90,627,932 to be raised and appropriated within the limitations of Proposition 2½

General Government: $35,657,822

Education: $39,871,531

Debt Service: $7,260,470

Enterprises: $7,838,109

- $2,885,227 contingent on a Proposition 2 ½ Ballot Election scheduled for June 18, 2024

General Government: $595,109

Education: $1,436,318

Debt Service: $800,000 (replaces $800,000 transfer)

Enterprises: $53,800

A budget funded only within the limits of Proposition 2 ½ is projected to result in reductions to school and municipal departmental budgets, with impacts to North Reading Public Schools, public services, public works, and other non-emergency services being felt in the upcoming budget years and beyond.

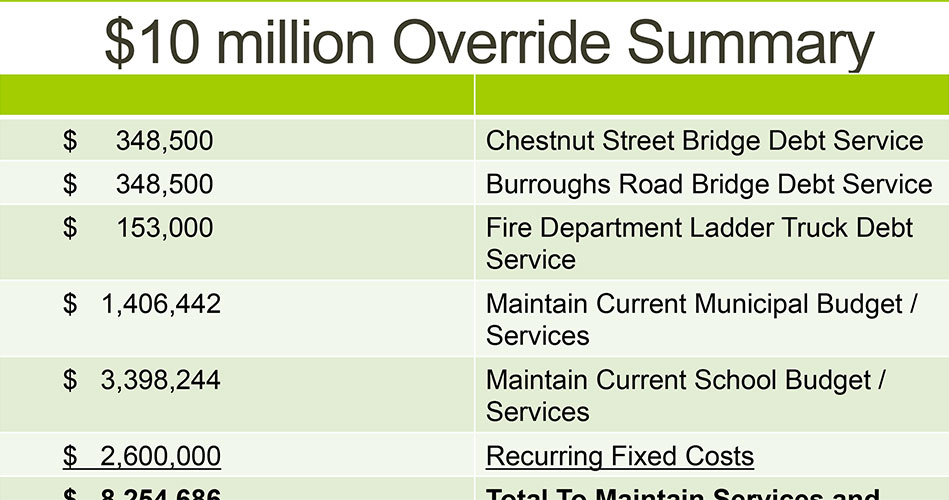

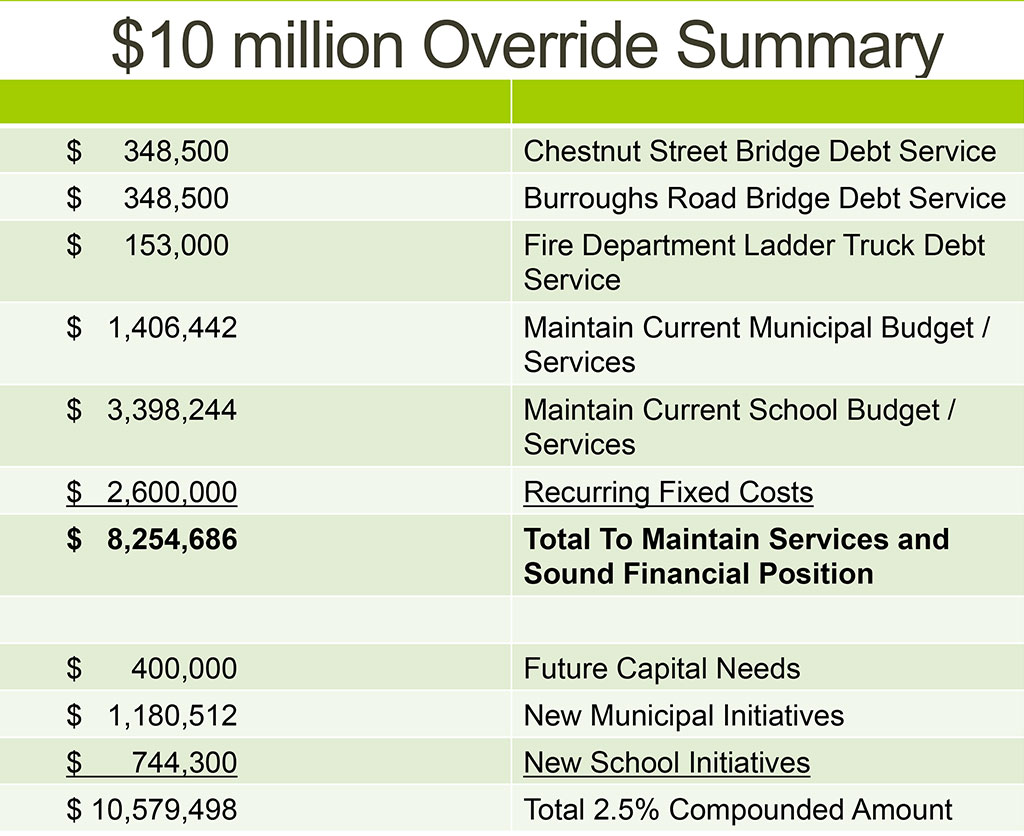

The Financial Planning Team has developed a proposal for a $10 million Proposition 2 ½ override (tax increase) to address critical capital needs, maintain school and municipal services, and maintain the town’s financial standing. This override is proposed to be phased in over three years and would be in addition to property tax increases that annually occur within the limits of Proposition 2 ½.

A summary of the use of the override funds is as follows:

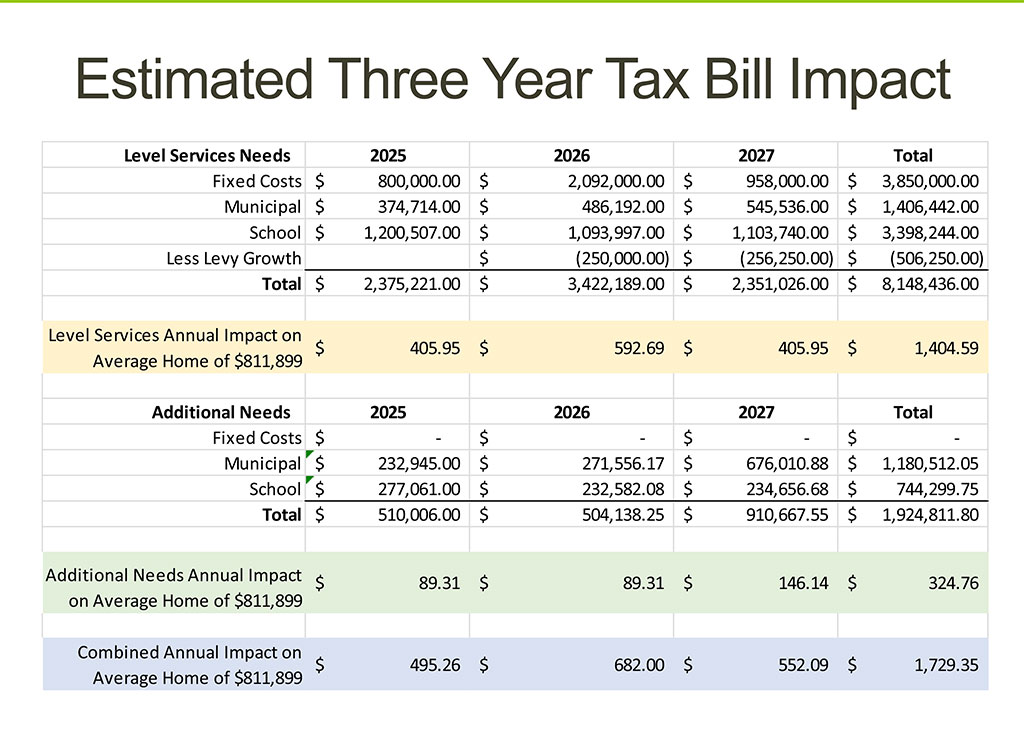

The $10 million would affect all residential, commercial, industrial, and personal taxpayers, and is proposed to be phased in over three years (subject to approval at Town Meeting each year) with tax bill impacts for the average single-family home (valued at $811,899) as follows:

The average single-family home valued at $811,899 is projected to see approximately a $250 annual tax increase per year without an override. This is subject to change in accordance with market conditions, individual home improvements, overall town property valuation, and other factors that annually affect property taxes.

The impact of a $10 million override on the average single-family home valued at $811,899 would be a total of $1,721.22 spread out over three years. The override would be a permanent tax increase. The total impact on the Tax Rate for all properties (including residential commercial, and industrial) is $2.12 per $1,000 of valuation over three years. To figure out how much it might mean for your property over three years, take the Assessed Value, divide it by 1,000, and multiply by $2.12.

It is important to note that in the absence of a Proposition 2 ½ Override, debt for the Chestnut Street and Burroughs Road bridges/culverts, as well as the Fire Department ladder truck, will likely need to be funded through a Debt Exclusion tax increase as soon as this fall.

The intent of this letter is not to advocate, scare, or sway opinion; rather, it is to provide information and to alert the community that the relatively stable levels of school and municipal services our residents have been provided in recent years will likely be impacted in the absence of additional revenue. North Reading Public Schools has identified reductions totaling $1.2 million including 15.2 full time equivalent (FTE) positions, for the upcoming fiscal year, and the reduction of municipal budgets by over $500,000 in the upcoming year will result in cuts needing to be made to municipal and school services the following year.

Residents are encouraged to learn more about, and participate in, the June 10 Town Meeting and the June 18 Proposition 2 ½ Election. More information may be found by reviewing the Spring Annual Town Meeting Warrant or visiting www.northreadingma.gov.