By MAUREEN DOHERTY

NORTH READING — In the absence of the town generating additional revenue there is going to be impacts in the schools and in municipal government, according to Town Administrator Michael Gilleberto.

“In the schools there will be a direct impact sooner but in the municipal government there will be significant impacts certainly in Fiscal Year 2026,” he told the Transcript after last week’s budget webinar that was attended virtually by 150 people.

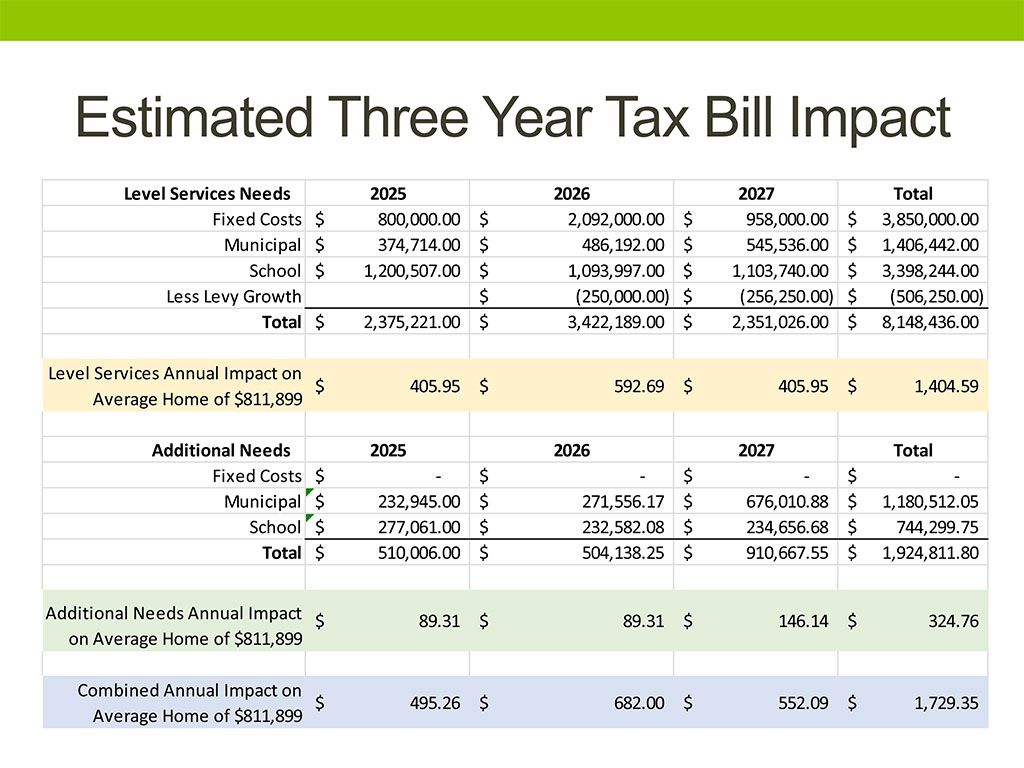

One slide describes where the $10 million dollars being requested in the override version of the budget would be spent over the three-year period for which it is projected to be necessary to be spent.

“Out of the $10 million, $8.2 million is to continue providing current services, so nothing new to school or municipal operations, and maintaining the stable financial outlook for the town,” Town Administrator Michael Gilleberto explained.

“It’s okay for people to be upset and frustrated” about programs that they do not feel are necessary to be funded, he said, adding, “It’s a tough balance but all of that is small in the context of 82% of the funding being requested is for current services and to maintain our town’s financial projections. That is something I hope the community understands in this decision-making process.”

“We’ll move forward if the town doesn’t want to go in that direction but people need to understand things will look different. There won’t be an opportunity to fund additional off-site programming for the Senior Center, for example,” he said.

Pointing to the slide titled “Estimated Three Year Tax Bill Impact” in the presentation, he said this represents a breakdown of $10M override request onto the average single-family tax bill.

“We are not here to force people to do something but we are here to educate them,” he said.

“You will see the roughly $1,405 of it is to maintain existing services and the town’s stable financial outlook and $325 is for additional needs that have been identified,” Gilleberto said.

The level services annual impact on an average single family home in North Reading, which is valued at $811,899, would be an additional $495 in FY25, $682 in FY26; and $552 in FY27.

If an override of $10.2M over three-years was approved, the town would apply $2,375,507 to provide level services in the FY25 budget ($800,000 toward fixed costs; $374,714 toward municipal budget and $1.2M toward the school budget). Doing so would add $406 to the tax bill of that average single-family homeowner.

And $510,000 would be applied to the “additional needs” identified in the FY25 budget to cover the gap in the municipal budget of $232,945 and in the school budget of $277,061. This would have an impact of $89 on the average single-family homeowner to arrive at the total of $495 for the fiscal year.

In the FY26 budget, the portion of the override funds that would be used is $3,422,189 to cover roughly $2M in fixed costs, $486,192 in municipal costs and $1,093,997 in school costs, less the levy growth of $250,000. The impact on the average single family home is $593.

The additional needs funded in year two with the override funds would be $504,138 ($271,556 municipal and $232,582 schools) for an impact of $89 on the average home for a total of $682.

In the third year of the override funds the town would deliver a level services budget for FY27 by applying $958,000 to fixed costs, $545,536 to municipal budget and $1,103,740 to the schools minus the $256,250 from levy growth for a total of $2,351,000 and a $405 impact on the average home. The portion applied to the additional needs budget would be $676,000 for the municipal budget and $234,656 for the schools for a total of $910,667 and an impact of $146 to the average homeowner, bringing the total FY27 impact to $552 and a three-year overall impact of $1,730.

Without an override

Without an override of Prop. 2 1/2, the tax bill of the average single-family homeowner valued at $811,000 will increase by $250 per year, subject to market conditions, he said.

Another way to calculate the impact of the override would be to add $2.12 onto the tax rate per $1,000 of valuation each property owner is now paying spread out over a three-year period.

A further consideration for the taxpayers would be without an operating override the town would still need to cover the debt incurred for the Chestnut Street and Burroughs Road culvert/bridge projects plus the replacement of the town’s ladder truck through a debt exclusion override and would face a reduction in services.

The override as currently proposed covers those three costs and keeps the services the town currently provides through its school and municipal budgets level funded.

The town’s Financial Planning Team will host an in-person workshop next Thursday, May 9 at 7:30 p.m. in the Distance Learning Lab at NRHS for the public to come and ask questions about the budget and how the town has arrived at its current proposals.